Contents

Platinum Capital One cardholders are invited to activate their cards to unlock a range of benefits and financial conveniences. The Capital One Platinum card is renowned for its versatility, offering users access to a host of features tailored to meet their financial needs. By activating their Platinum Capital One card, users gain access to an array of benefits, including cashback rewards, fraud protection, and convenient online account management tools. Activation is a simple process that ensures cardholders can begin utilizing their card’s features and enjoying its perks right away.

Whether it’s building credit, managing expenses, or simply enjoying the peace of mind that comes with a trusted financial partner, activating the Platinum Capital One card marks the beginning of a journey towards financial empowerment and security. With Capital One’s commitment to innovation and customer satisfaction, activating the Platinum card is the first step towards a brighter financial future.

About Capital One Platinum Credit Card

The Capital One Platinum Credit Card stands out in the realm of credit cards tailored for individuals with poor credit due to its advantageous features, notably its absence of an annual fee. Unlike many other unsecured cards designed for this demographic, which often impose annual fees upwards of $70, the Capital One Platinum Credit Card offers users the opportunity to build their credit profile without incurring such costs. This fee-free structure is particularly beneficial over time, as it eliminates the financial burden that annual fees can impose.

Moreover, this credit card offers a multitude of additional benefits beyond its fee waiver, including rewards and travel protections, enhancing its appeal to consumers seeking to bolster their credit standing. Notably, it exempts users from foreign transaction fees, making it a favorable choice for international purchases.

One standout feature of the Capital One Platinum Credit Card is its unique policy of automatically increasing the cardholder’s credit limit every six months. This proactive measure not only provides users with greater financial flexibility but also contributes to improving their credit score by reducing their credit utilization rate.

Overall, the Capital One Platinum Credit Card emerges as an attractive option for individuals aiming to cultivate a positive credit history without the burden of an annual fee. Furthermore, its user-friendly features, such as the ability to make online payments from the outset, further enhance its appeal and accessibility to a broad spectrum of consumers.

Benefits Of Using Capital One Platinum Credit Card

Activating your Platinum Capital One card unlocks a plethora of benefits tailored to enhance your financial well-being and convenience:

1. No Annual Fee: Unlike many other credit cards for individuals with limited or poor credit, the Platinum Capital One card charges no annual fee, providing a cost-effective option for building credit.

2. No Foreign Transaction Fees: Enjoy seamless international transactions without incurring additional fees, making it an ideal companion for travelers or those making purchases abroad.

3. Credit Limit Increases: Benefit from automatic credit limit increases every six months, empowering you with greater purchasing power and potentially improving your credit utilization ratio and credit score.

4. Opportunity for Credit Building: By activating and responsibly using your Platinum Capital One card, you can establish and strengthen your credit profile, paving the way for future financial opportunities.

5. Rewards and Travel Protections: Access additional perks such as rewards and travel protections, adding value to your card usage and enhancing your overall experience.

6. Convenient Online Payments: Seamlessly manage your card account and make payments online, providing flexibility and accessibility in managing your finances.

Overall, activating your Platinum Capital One card offers a pathway to financial empowerment, with a range of benefits designed to support your credit-building journey while providing convenience and peace of mind in your everyday transactions.

Read Also:- Walgreens Credit Card Login And Register In 3 Easy Steps

Platinum Capitalone Come Activate Steps

Steps to Activate Account Online

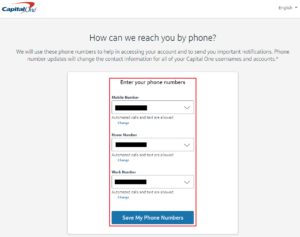

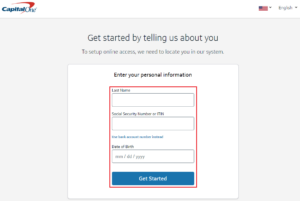

To activate your Capital One card via the official website at capitalone.com/activate, follow these step-by-step instructions

1. Visit the Capital One Activation Website: Open your web browser and navigate to the official activation site of Capital One by entering www.capitalone.com/activate in the address bar.

2. Log into Your Account: Once on the activation website, locate and click on the “Login” button. Enter your login credentials, including your username and password, to access your Capital One account. Ensure that you provide the correct information to successfully log in.

3. Select Your Card: After logging in, navigate to the section where you can manage your cards. Locate the specific card that you wish to activate from your Capital One account.

4. Enter the Security Code: On the back of your Capital One card, locate the security code. This is typically the last three digits printed on the signature panel. Enter these digits into the corresponding field on the activation website.

5. Complete Activation: Once you have entered the security code, review the information to ensure accuracy. Then, follow any additional prompts or instructions provided on the website to complete the activation process. Your Capital One card is now ready to use and activated for transactions.

By following these detailed steps, you can successfully activate your Capital One card via the online activation portal at capitalone.com/activate, ensuring seamless access to your credit or debit card benefits.

Capital One Platinum Activate Using The Mobile App

To activate your Capital One Platinum card using the Capital One Mobile app on your iOS or Android device, follow the step-by-step instructions below:

1. Open the Capital One Mobile App: Locate the Capital One Mobile app on your device and open it by tapping on the app icon.

2. Log In to Your Account: Tap on the “Log in” option and enter your login credentials. Ensure that you use the same username and password that you use for accessing your Capital One Online account.

3. Navigate to the Profile Section: Once logged in, navigate to the Profile section within the app. This section is typically accessible from the menu or navigation bar.

4. Choose the Account Tab: Within the Profile section, locate and select the “Account” tab. This tab displays information related to your Capital One accounts, including any associated cards.

5. Locate Your Card: Your Capital One Platinum card should be listed under the Account tab. Identify your card from the list of accounts displayed.

6. Activate Your Card: After selecting your Capital One Platinum card, look for the “Activate” button or option associated with it. Tap on the “Activate” button to initiate the activation process for your card.

7. Follow Any Prompts: Depending on the app’s interface, you may need to follow additional prompts or provide certain information to complete the activation process. Ensure that you carefully follow any on-screen instructions provided.

8. Confirmation: Once you have successfully completed the activation process, you should receive a confirmation message or notification indicating that your Capital One Platinum card has been activated and is ready for use.

By following these detailed steps within the Capital One Mobile app, you can easily and securely activate your Capital One Platinum card, enabling you to access its benefits and begin using it for transactions.

Capital One Platinum Activate Via Phone/Offline Mode

To activate your Capital One Platinum card using the phone method, follow these steps:

1. Dial the Activation Number: Locate the activation number provided on capitalone.com or on the sticker affixed to your card. Dial 800-227-4825 to reach the Capital One activation hotline.

2. Wait for a Representative: Once you’ve dialed the number, wait for a representative to answer your call. The representative will assist you in activating your Capital One Platinum card.

3. Provide Identification: For identity verification purposes, you may be asked to provide certain personal information, such as your social security number. Ensure that you have this information readily available.

4. Refer to Your Card Manual: If the representative asks for specific information or refers you to your card manual, be prepared to provide any details or reference numbers indicated in the manual.

5. Follow Instructions: Follow the representative’s instructions carefully to complete the activation process for your Capital One Platinum card. They may guide you through a series of prompts or verification steps to ensure successful activation.

6. Confirmation: Once you’ve completed the activation process as instructed by the representative, you should receive confirmation that your Capital One Platinum card has been successfully activated and is ready for use.

By following these steps and engaging with the Capital One activation hotline, you can easily activate your Capital One Platinum card over the phone, allowing you to start using it for transactions and enjoying its benefits.

Conclusion

Activating your Platinum Capital One card opens the door to a range of benefits and conveniences tailored to enhance your financial management experience. With features like no annual fee, no foreign transaction fees, and automatic credit limit increases, this card offers a cost-effective solution for building credit and accessing rewards. Whether you activate your card online, through the mobile app, or via phone, the process is straightforward and ensures that your card is ready for immediate use. By taking advantage of these activation options and leveraging the benefits of your Platinum Capital One card, you can embark on a journey towards financial empowerment and responsible credit management.